The world of finance is undergoing a seismic shift, with DeFi and NFTs at the forefront. As we navigate this new terrain, Aave emerges as a beacon, illuminating the path of decentralized lending. Let’s delve deeper into this fascinating world.

Introduction to DeFi and NFTs

What is DeFi?

DeFi, short for Decentralized Finance, is the revolutionary concept of financial systems and services that operate without traditional intermediaries. It’s a world where blockchain technology and smart contracts replace banks, brokers, and other middlemen. This not only democratizes finance but also makes it more transparent and accessible. With DeFi, financial control is handed back to the people, enabling them to manage and grow their assets in a decentralized ecosystem.

The rise of NFTs

Non-Fungible Tokens, or NFTs, have taken the digital world by storm. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-for-one basis, NFTs are unique. Each token has distinct information or attributes that make it irreplaceable and, therefore, collectible. From digital art to virtual real estate, NFTs are redefining ownership in the digital age. Their rise signifies a shift in how we perceive value, merging the tangible with the intangible in unprecedented ways.

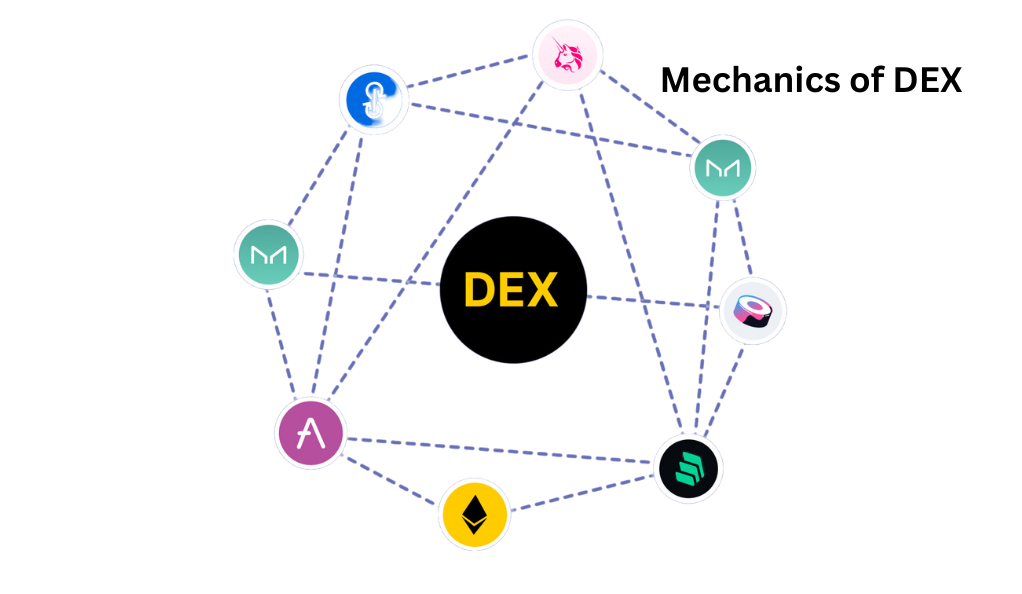

The Mechanics of Decentralized Exchanges

How they work: Decentralized exchanges, commonly referred to as DEXs, operate autonomously without a central authority. They rely on smart contracts to facilitate trades directly between users. This peer-to-peer mechanism ensures that users retain control of their funds, only parting with them once the trade is executed. Moreover, DEXs operate on a blockchain, ensuring transparency and security for all transactions.

Benefits over centralized exchanges: Centralized exchanges, while popular, come with their set of challenges, including security vulnerabilities and a lack of transparency. DEXs, on the other hand, offer several advantages. They reduce the risk of hacks and unauthorized access as users retain control of their private keys. Additionally, with no central authority, DEXs offer enhanced privacy, ensuring user data isn’t shared or sold. Lastly, they provide global access without restrictions, making financial systems more inclusive.

Yield Farming and Liquidity Mining

Understanding Yield Farming

Yield farming, often dubbed as the rocket fuel of DeFi, is a method where users lend or stake their crypto assets in return for rewards. It’s akin to traditional banking, where you earn interest on deposited money, but supercharged. By staking assets in a particular protocol, users receive tokens as rewards, which can be further staked to earn additional rewards, creating a compounding effect.

Liquidity Mining

A deeper dive Liquidity mining is closely related to yield farming but focuses on providing liquidity to decentralized exchanges. Users deposit their assets into a liquidity pool, facilitating trades on the platform. In return, they earn a share of the trading fees. This method not only provides users with passive income but also ensures that DEXs have sufficient liquidity to operate efficiently.

Aave: The Vanguard of Decentralized Lending

History and Background

Aave, derived from the Finnish word meaning ‘ghost’, has made a spectral impact in the DeFi space. Founded in 2017 by Stani Kulechov, it started as ETHLend, a simple peer-to-peer lending platform. However, with its rebranding to Aave, it expanded its offerings, introducing flash loans and pioneering innovations that have set industry standards.

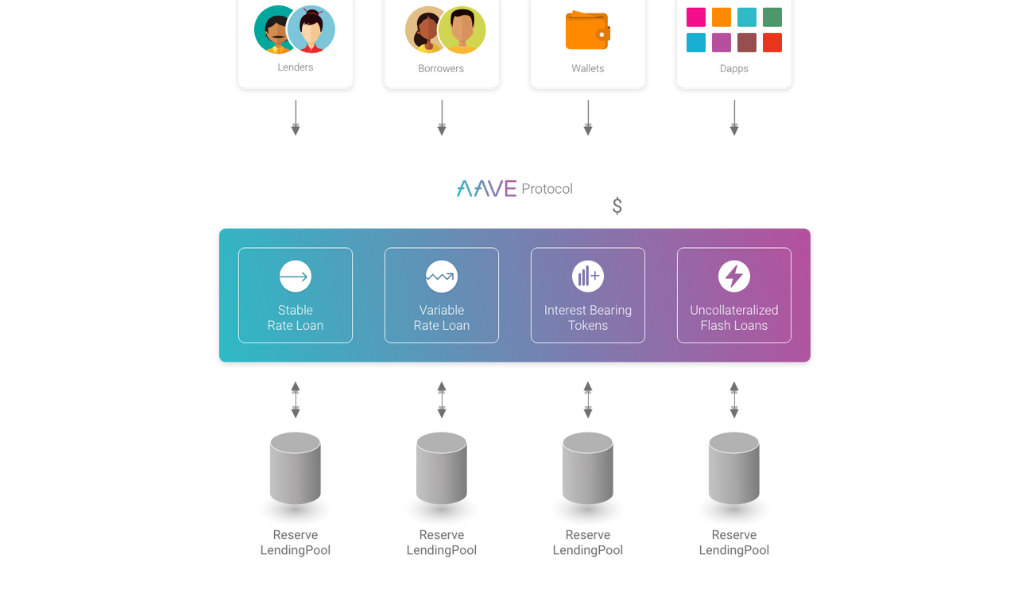

How Aave Works

- Lending on Aave: Aave’s lending mechanism is straightforward yet revolutionary. Users deposit their assets, which are then transformed into equivalent aTokens. These aTokens represent the user’s deposit and continuously earn interest. The beauty of Aave lies in its passive earning potential. As the market rates adjust, so does the interest on aTokens, ensuring users always get competitive returns.

- Borrowing on Aave: Borrowing on Aave is flexible and user-centric. By depositing collateral, users can borrow assets, choosing between stable or variable interest rates. This flexibility allows users to strategize their loans, optimizing for market conditions. Moreover, Aave’s decentralized nature ensures transparency, with all loan terms executed via smart contracts.

Investing in and Understanding NFTs

What are NFTs?

NFTs, or Non-Fungible Tokens, represent a seismic shift in the digital ownership paradigm. Unlike traditional digital assets, which can be easily replicated, NFTs are unique and cannot be exchanged on a like-for-like basis. This uniqueness is verified using blockchain technology, ensuring the authenticity and rarity of each NFT. From digital art to music, NFTs are creating new avenues for creators to monetize their work.

How to invest in NFTs

Investing in NFTs requires a blend of traditional investment acumen and an understanding of the digital landscape. Start by researching popular NFT platforms like OpenSea or Rarible. Once you’ve identified a potential NFT, delve into its history, rarity, and the reputation of the creator. Remember, while NFTs can offer substantial returns, they also come with risks. It’s essential to stay informed and make educated decisions.

Conclusion

The realms of DeFi and NFTs are not just technological advancements; they represent a shift in how we perceive value, ownership, and finance. Platforms like Aave are at the forefront, democratizing finance and making it more accessible. As we stand on the cusp of this financial revolution, one question remains: Are you ready to be a part of it?

FAQs

DeFi operates on blockchain and eliminates middlemen, offering a more decentralized approach.

While Aave uses advanced security measures, it’s essential to do your research and understand the risks involved in any investment.

Yes, you can sell your NFTs in the marketplace and convert them back to cryptocurrency.

Interest rates on Aave can be more competitive due to the decentralized nature and the elimination of traditional banking overheads.

NFTs represent unique digital ownership, making them rare and, in many cases, collectible, which drives their value.