Cryptocurrencies have redefined the landscape of investment, offering unparalleled opportunities and challenges. To navigate this ever-evolving realm successfully, understanding and implementing effective investment strategies is paramount. In this comprehensive guide, we’ll delve into various investment approaches tailored to the unique dynamics of the crypto market. Whether you’re a cautious investor seeking stability or an adventurous one chasing exponential growth, these strategies will equip you with the tools to maximize your returns while effectively managing risks.

Understanding the Crypto Market

The cryptocurrency market operates on the principles of decentralization and blockchain technology. Unlike traditional financial markets, the crypto sphere is not influenced by conventional economic factors. Instead, its volatility and trends are often driven by technological advancements, regulatory developments, and market sentiment. Navigating this intricate environment requires a foundational understanding of blockchain, consensus mechanisms, and the specific use cases of different cryptocurrencies.

Conservative Investment Strategies

HODLing: Long-Term Investment

HODLing, derived from a misspelling of “hold,” involves purchasing a cryptocurrency and holding onto it for an extended period, regardless of price fluctuations. This strategy aligns with the belief that the long-term potential of the asset will outweigh short-term volatility. HODLing is favored by risk-averse investors who prioritize the fundamental value of a cryptocurrency over speculative gains.

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is a disciplined approach to investment. Investors allocate a fixed amount of funds at regular intervals, regardless of the cryptocurrency’s market price. This strategy minimizes the impact of market volatility on the overall investment. Over time, DCA can lead to a lower average purchase price and reduced exposure to sudden market fluctuations.

Stablecoin Investments

Stablecoins play a pivotal role in conservative crypto portfolios. These cryptocurrencies are pegged to traditional fiat currencies, such as the US Dollar or Euro, ensuring their value remains relatively stable. For risk-averse investors, allocating a portion of the portfolio to stablecoins provides a safe haven during times of heightened market volatility.

Moderate Investment Strategies

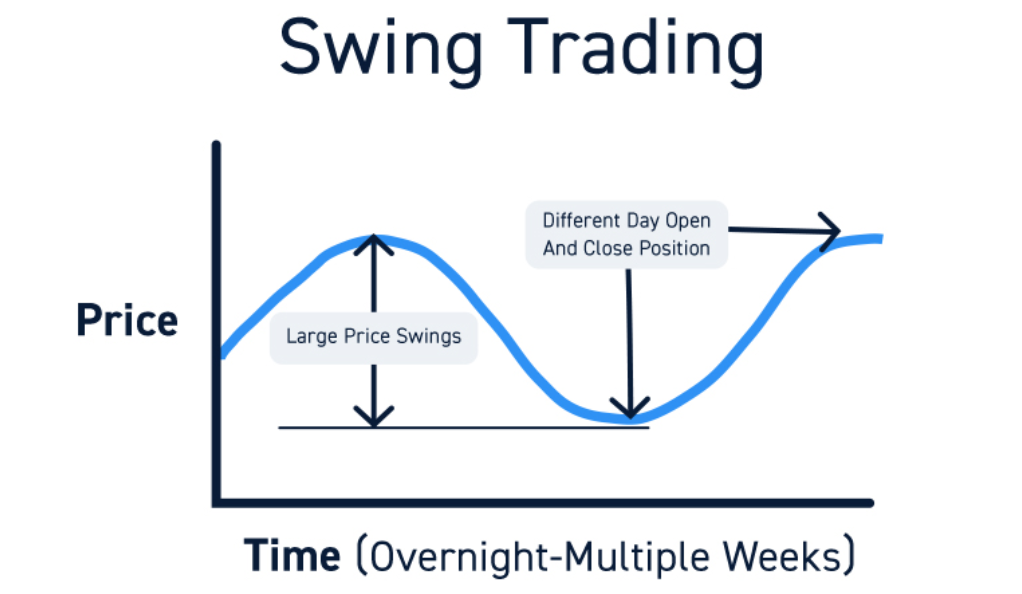

Swing Trading

Swing trading involves capitalizing on short- to medium-term price movements within a defined range. Traders aim to identify trends and profit from price fluctuations. This strategy requires technical analysis skills and a keen understanding of market patterns.

Yield Farming

Yield farming is a popular strategy within the decentralized finance (DeFi) space. Investors provide liquidity to DeFi platforms in exchange for rewards. While potentially lucrative, yield farming demands a comprehensive understanding of different protocols and their associated risks.

Index Funds

Index funds offer diversification by providing exposure to a portfolio of cryptocurrencies. These funds aim to replicate the performance of a specific market index. This approach suits investors seeking balanced exposure across multiple assets, reducing the risk associated with investing in a single cryptocurrency.

Aggressive Investment Strategies

Day Trading

Day trading involves executing multiple trades within a single day to capitalize on short-term price movements. This high-risk, high-reward strategy demands quick decision-making, technical analysis expertise, and strict risk management.

ICO Investments

Initial Coin Offerings (ICOs) allow investors to fund new cryptocurrency projects in their early stages. This strategy carries substantial risk due to the speculative nature of new ventures. However, successful ICO investments can yield significant returns.

Margin Trading

Margin trading amplifies potential gains by allowing investors to borrow funds to increase their trading position. However, this strategy magnifies losses as well, making it suitable only for experienced traders with a solid risk management plan.

Risk Management in the Crypto Market

Diversification

Diversifying your cryptocurrency portfolio across different assets is a fundamental risk mitigation strategy. A diverse portfolio can help offset losses from underperforming assets with gains from others.

Setting Stop-Loss Orders

Stop-loss orders are essential tools in risk management. These automated orders trigger a sale when a cryptocurrency’s price reaches a specified level, preventing excessive losses during market downturns.

Research and Due Diligence

Thorough research is crucial before investing in any cryptocurrency. Understanding the technology, team, use case, and market trends can significantly enhance your decision-making process.

Combining Strategies for Optimal Results

Effective crypto investment often involves blending strategies that align with your risk appetite and financial goals. For instance, combining stablecoin investments with long-term HODLing can provide stability while maintaining exposure to potential growth.

Conclusion

The cryptocurrency market offers a plethora of investment opportunities, each catering to different risk profiles. Whether you’re a conservative investor or an aggressive risk-taker, crafting a well-informed investment strategy is the key to navigating this complex yet rewarding landscape.

Investing in cryptocurrencies requires thorough knowledge, strategic thinking, and the ability to adapt to a fast-changing environment. By choosing the right investment strategies and incorporating effective risk management techniques, you can embark on a successful journey toward financial growth and stability.

FAQs

Day trading demands a deep understanding of market dynamics and technical analysis, making it more suitable for experienced traders.

ICO investments carry high potential for gains, but they are also accompanied by a substantial risk due to the speculative nature of new projects.

Absolutely. Your investment strategy should evolve as you gain more knowledge and your risk tolerance changes over time.

While most index funds focus on major cryptocurrencies, some may incorporate a mix of smaller and emerging ones.

Numerous online resources provide insights into decentralized finance and yield farming techniques. Thorough research is essential before engaging in DeFi activities.