Have you ever paused in your day to truly contemplate the profound potential of cryptocurrencies? It’s easy to get caught up in the headlines about wild price swings and the technical jargon of decentralized networks. However, beneath these surface-level narratives, there exists a vast world brimming with opportunities. When we delve deeper into the essence of cryptocurrency, especially Bitcoin (BTC), we uncover its potential in bridging the socio-economic divide that persists globally. Its decentralized nature and global accessibility present a unique tool for empowerment and social inclusion. Through this lens, Bitcoin isn’t just a digital currency, but a catalyst for greater societal equity and transformation.

Historical Overview

The concept of cryptocurrency, with Bitcoin at its vanguard, was birthed over a decade ago as a reaction to the frailties of the traditional financial system. Introduced by the pseudonymous Satoshi Nakamoto, Bitcoin promised a decentralized approach to money, free from the grip of major banks and governments. As the years passed, this vision blossomed, paving the way for a myriad of digital currencies and technologies, transforming our understanding of finance and opening new pathways for global economic participation.

The Dawn of Cryptocurrencies

A decade ago, Bitcoin made its groundbreaking debut, heralding a new era in the realm of finance. Conceived by the enigmatic Satoshi Nakamoto, its aim was not merely to introduce a digital currency, but to reimagine the very essence of economic power and control. This wasn’t just about transactional evolution; it was about leveling the financial playing field, offering greater access and empowerment to individuals worldwide. Bitcoin’s emergence signaled not just the birth of a new currency, but the dawn of a potential financial democratization.

Evolution

From its inception as a simple digital coin, the realm of cryptocurrency has undergone a profound transformation. Ethereum ushered in a new era with its innovative concept of smart contracts, adding layers of functionality and programmability to digital assets. Beyond that, the rise of decentralized finance platforms further pushed the boundaries, challenging traditional financial systems and offering more autonomous financial solutions. This evolutionary journey has seen the crypto world not only grow, but also diversify and amplify its impact on global economics and technology.

Factors Influencing BTC Price

- Supply and Demand Dynamics: The age-old economic principle still holds. As more people adopt BTC, its demand (and subsequently, its price) increases.

- Regulatory Landscape: Governments and their policies significantly influence the price.

- Macro Economic Factors: Events like recessions or market crashes can see a spike in BTC adoption.

Technical Analysis

Bullish Trends

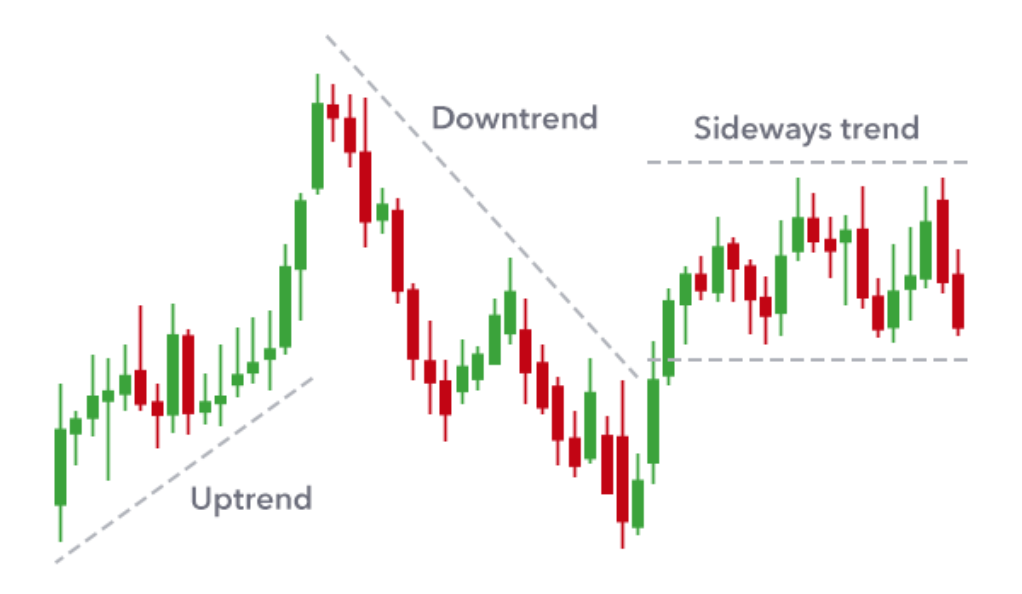

In the world of finance and investment, the term “bullish” stands as a testament to optimism and the anticipation of rising asset values. Bullish trends are characterized by sustained periods where prices are on an upward trajectory, often driven by strong fundamentals, positive news, or investor sentiment. In many scenarios, these trends can be identified by chart patterns, increased trading volumes, and other technical indicators that hint at a continued upward momentum. Factors like robust economic data, positive earnings reports, or even geopolitical stability can all serve as catalysts for such trends. As investors recognize these cues, they often increase their investments, further fueling the bullish cycle. Understanding and capitalizing on bullish trends is essential for any investor seeking to maximize returns and stay ahead of the market curve.

Bearish Downturns

Within the intricate tapestry of financial markets, “bearish” represents periods of pessimism and expectations of declining asset values. When markets are in a bearish downturn, prices tend to decrease over a sustained period, reflecting a combination of weakening fundamentals, negative news, or a shift in investor sentiment. These downturns can be visualized through chart patterns, often accompanied by decreased trading volumes and other technical indicators signaling a potential downward spiral. Various triggers, such as disappointing earnings reports, global economic slowdowns, geopolitical tensions, or even regulatory changes, can precipitate bearish movements. As investors grow wary and reduce their positions, the downtrend can become more pronounced, leading to further sell-offs. Navigating bearish downturns requires astute market analysis, prudent decision-making, and sometimes the patience to wait for recovery or the identification of new opportunities.

Future Predictions

- Mainstream Adoption: As we bridge the digital divide, expect to see more users and applications.

- Greater Regulation: As governments catch up, regulatory clarity can drive BTC to newer heights.

- The Pinnacle of Social Inclusion: Cryptocurrencies can potentially become the cornerstone of inclusive economies.

How is Crypto Promoting Social Inclusion?

- Banking the Unbanked: Think about the millions without access to traditional banking. With just a smartphone, they can now enter the global economy.

- Remittance Revolution: Sending money across borders is no longer a pricey affair.

- Empowerment: Direct control over one’s finances without intermediaries means more power to individuals.

Challenges to Overcome

- Volatility: The notorious price swings can be daunting for many.

- Technological Barriers: Despite advancements, there’s still a learning curve to cryptocurrency.

Conclusion

Isn’t it fascinating how a digital entity can have such profound socio-economic implications? Cryptocurrencies, led by BTC, are not just financial tools; they’re harbingers of a new era. An era where financial systems are not just for the privileged few but for every individual. Imagine a world where everyone, regardless of their socio-economic background, has an equal stake in the global economy. That’s the power of crypto in social inclusion.

FAQs

BTC allows people without access to traditional banking systems to participate in the global economy.

While there’s volatility, the benefits of decentralization and empowerment often outweigh the risks for many.

Cryptocurrencies can dramatically reduce transaction fees and transfer times, making it easier to send money across borders.

Regulatory clarity can drive adoption. Governments can either hinder or help this movement.

It’s not about replacement but evolution. Crypto offers solutions to many of traditional banking’s shortcomings.