Ever wondered about the world’s perspective on cryptocurrencies? The maze of digital currencies, notably Bitcoin, has prompted nations to respond in varied ways.

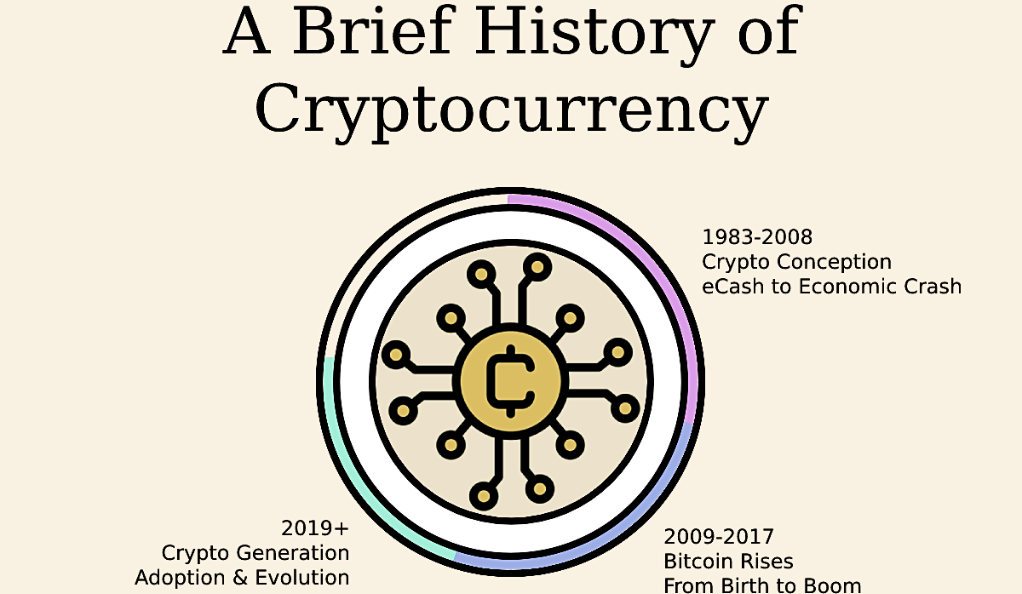

Brief History of Cryptocurrency

The story of cryptocurrency started with Bitcoin’s inception in 2009. It represented a decentralized and uncontrolled form of digital currency, marking a break from traditional banking systems. Its remarkable growth grabbed attention worldwide, and governments began to realize the potential implications of this new financial landscape.

Over the next decade, a diverse range of digital currencies emerged, each promising unique features and applications. This rapid proliferation prompted regulators to seriously consider how these new currencies fit into existing legal frameworks.

Importance of Regulation

Why the need for regulation? Picture a digital Wild West without rules. The lack of oversight in the crypto landscape would lead to chaos, rampant scams, and could potentially disrupt economies. Regulations aim to enforce a sense of order, protect individual investors, maintain market integrity, and combat fraudulent activities.

Without regulatory safeguards, the credibility and stability of cryptocurrencies would be at risk. With appropriate regulations, investors can have confidence in the security and legitimacy of their digital assets.

Global Landscape of Crypto Regulations

North America

In the U.S., regulatory agencies like the SEC oversee specific aspects of cryptocurrency to maintain market integrity and protect consumers. Regulations differ from state to state, reflecting the complexities of federal governance. Some states welcome crypto with open arms, while others maintain a more cautious approach.

Canada, on the other hand, is considered crypto-friendly, actively endorsing various blockchain projects and ICOs. Its regulatory approach focuses on innovation while ensuring consumer protection.

Europe

Europe’s stance on crypto regulation is multifaceted. Nations like Switzerland have embraced cryptocurrencies, positioning themselves as hubs for crypto innovation. Progressive laws have encouraged businesses to operate in this neutral ground.

In contrast, other European countries are still fine-tuning their regulatory approach, striving to balance technological advancement with investor protection. Recent regulations by the EU aim to provide a comprehensive framework for all member states.

Asia

Asia’s approach to cryptocurrency is a study in contrasts. Japan has been a pioneer, legitimizing Bitcoin as a payment method and implementing clear regulations. They have positioned themselves as a leader in crypto acceptance and innovation.

China, however, has adopted a more restrictive stance. While initially supporting blockchain technology, they have since banned Bitcoin trading and ICOs, highlighting concerns over financial stability and social order.

Legal Developments in Cryptocurrency

Recent Changes

In the fast-evolving world of cryptocurrencies, several countries are either drafting or updating legislation. Recent changes encompass defining legal statuses for different digital assets, setting clear frameworks for ICOs, and imposing specific regulations to ensure consumer protection.

These changes reflect a broader recognition of cryptocurrencies within the international financial landscape and demonstrate governments’ efforts to adapt and integrate these new technologies.

Predicted Future Changes

Speculation about future regulatory changes is rife. Many countries may be considering introducing their digital currencies or amending laws to foster innovation while safeguarding investors’ interests.

International collaboration may also shape future legal landscapes, as nations work together to address common challenges and opportunities presented by the global nature of cryptocurrencies.

Tax Implications of Crypto Investments

Factors Influencing Crypto Taxation

The tax implications of crypto investments vary widely across jurisdictions. Factors such as the nature of the transaction, the investor’s residency, and the classification of the token can significantly impact tax liabilities. In some jurisdictions, crypto gains are treated as capital gains, while in others, they might be considered regular income.

Best Practices for Compliant Investing

Security Measures

Investing in cryptocurrencies requires robust security measures. Utilizing hardware wallets, employing two-factor authentication, and maintaining vigilance against phishing attempts are essential. Investors should understand that the decentralized nature of cryptocurrencies means that a small mistake could result in significant financial loss.

Staying Updated

Keeping abreast of the dynamic crypto landscape is key. Regularly reviewing local regulations, attending relevant webinars, or joining cryptocurrency communities can ensure that investors are well-informed.

Access to accurate and timely information helps in making responsible investment decisions. Stay in the loop, and you’ll navigate the complexities of the crypto world with confidence.

Conclusion

Navigating the intricate web of international cryptocurrency regulations may seem like a daunting task, but with the right information and guidance, it is entirely manageable. Knowledge truly is power in the crypto world. By staying informed, investors can not only reap profits but also contribute to a transparent, secure, and well-regulated crypto environment. Together, we can shape the future of digital currencies.

FAQs

Nations prioritize based on economic factors, perceived risks, and potential benefits.

No, some might be treated as securities, others as commodities, and some might not be recognized at all.

Non-compliance might lead to penalties, loss of investment, or legal actions.

Regulations can govern how people use and invest in cryptocurrencies, but they can’t control the decentralized ledger technology underlying them.

Research, consult legal experts, and stay updated on local regulations.