In the complex, multifaceted world of cryptocurrencies, Litecoin stands out as a unique blend of stability and innovation. Much like sailors look to lighthouses for guidance amidst turbulent seas, crypto enthusiasts and investors regularly lean on Litecoin for insights into the larger market. With a deeper understanding of the evolving landscape, we can all indeed ‘stay illuminated.’ This piece dives into the heart of real-time market analysis and trend forecasting, primarily focusing on Litecoin.

Understanding Price Movements

Price movements, whether in the context of goods and services, stocks, commodities, currencies, or other financial instruments, are influenced by a myriad of factors. Gaining an understanding of these movements is crucial for investors, businesses, and policy-makers to make informed decisions. Let’s delve deeper into the key aspects of price movements.

Macro Trends

Global economic factors, from inflation rates to geopolitical tensions, can inadvertently shape the course of the crypto realm. Although cryptos like Litecoin offer a degree of detachment from traditional financial systems, they’re not entirely isolated. For instance, during economic recessions, we’ve observed a surge in cryptocurrency adoption, with Litecoin often seen as a stable alternative.

Tech Developments

Litecoin’s technological advances have always been at the forefront. Whether it’s the introduction of SegWit or its pioneering role in the Lightning Network, any technical progress can steer price trends. Investors are urged to stay updated on these developments, as they not only shape Litecoin’s future but often ripple through the larger crypto ecosystem.

Market Sentiment

The emotional pulse of the market, influenced by news, media, and influential crypto voices, can dictate Litecoin’s price trajectory. Positive developments can induce bullish sentiment, while negative news can bear down on prices. Keeping a finger on the sentiment pulse ensures investors aren’t caught off-guard.

Gauging Market Sentiment

Litecoin (LTC), often dubbed as the “silver to Bitcoin’s gold,” is one of the oldest and most established cryptocurrencies. Since its inception in 2011, the coin has experienced numerous market cycles. Understanding the sentiment surrounding Litecoin is crucial for both long-term holders and potential investors. Here’s how to gauge the market sentiment:

- Fear and Greed Index: This invaluable tool is a reflection of market emotions. History has shown us that periods of intense fear can be buying opportunities, hinting at an undervalued market. Conversely, excessive greed often precedes market corrections, signaling a potential overvaluation.

- Sentiment Analysis: Digital tools that comb through Twitter, Reddit, and various news outlets offer insights into the prevailing market mood regarding Litecoin. An uptick in positive sentiment could be indicative of a bull run, while pervasive negative sentiment might signify a downturn.

- Volume Analysis: Analyzing trading volumes provides insights into the strength behind price movements. High volumes during an uptrend suggest strong buying interest, while high volumes during downtrends indicate strong selling interest.

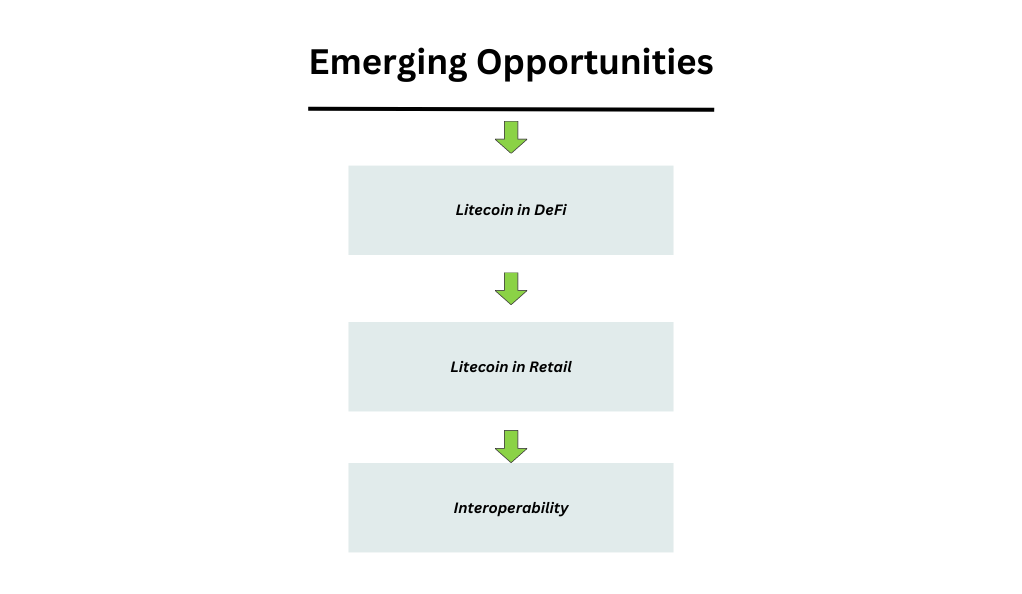

Emerging Opportunities

Litecoin, as one of the pioneering cryptocurrencies, has paved its way in the market with a reputation for faster transaction speeds and a strong developer community. As the crypto landscape continues to evolve, several new opportunities are emerging for Litecoin. Here’s a closer look:

Litecoin in DeFi

The DeFi sector is rapidly transforming the financial world. Litecoin, with its stability and reputation, has a pivotal role to play. By being integrated into DeFi platforms, whether it’s for lending, borrowing, or staking, Litecoin’s utility and demand can see substantial growth.

Litecoin in Retail

Merchants worldwide are warming up to Litecoin as a credible payment method. This trend, while already on the rise, has the potential to snowball, making Litecoin a mainstream transactional cryptocurrency. As more merchants hop on board, users and investors will likely witness increased adoption rates.

Interoperability

The future of cryptocurrencies lies in collaboration and interconnectedness. As blockchains focus on communication and integration, Litecoin’s ability to seamlessly work with other platforms will be crucial. Any partnerships or integrations that foster this interoperability are bound to open new avenues for growth and utility.

Conclusion

In conclusion, the crypto landscape, with Litecoin at its vanguard, is ever-changing. Staying illuminated means continuously educating oneself, being receptive to shifts in market sentiment, and seizing emerging opportunities with both hands. Whether you’re a seasoned investor or a newbie, understanding these trends is essential to navigate the tumultuous waters of the crypto world successfully. And as always, stay luminous with Litecoin Luminescence.

FAQs

Litecoin’s price is influenced by a combination of macroeconomic trends, technological developments within the Litecoin network, and the overall market sentiment. Economic indicators, global events, and government regulations can indirectly affect Litecoin’s value. Furthermore, any advancements or updates in Litecoin’s technology can lead to price fluctuations. Lastly, the general mood, perceptions, and attitudes of investors, which can be affected by news, media coverage, or influential voices in the crypto community, can heavily sway Litecoin’s price.

Market sentiment for Litecoin can be gauged using various tools and methods. The Fear and Greed Index offers insights into the emotional state of the market. When there’s extreme fear, it might suggest a buying opportunity, while excessive greed could indicate a pending market correction. Sentiment analysis tools that analyze discussions and trends on platforms like Twitter and Reddit provide insights into the prevailing mood around Litecoin. Additionally, looking at trading volumes can offer cues about the strength behind specific price movements.

Litecoin presents several emerging opportunities in the crypto landscape. As the Decentralized Finance (DeFi) sector expands, Litecoin’s role within this realm offers promising prospects, especially in lending, borrowing, or staking platforms. Moreover, with more merchants accepting Litecoin as a mode of payment, its role in retail is growing, indicating a trend towards mainstream adoption. Lastly, as different blockchain projects focus on interoperability, Litecoin’s potential collaborations and integrations can open up new avenues for growth and utility.

Interoperability refers to the ability of different blockchain platforms to communicate and integrate seamlessly. For Litecoin, interoperability signifies its potential to work collaboratively with other blockchains, enhancing its utility across the crypto space. As the future of cryptocurrencies leans towards increased collaboration and interconnectedness, Litecoin’s successful integration with other platforms will be pivotal for its growth and relevance in the evolving ecosystem.

Litecoin’s growing acceptance in retail is a strong indicator of its increasing mainstream appeal. As more merchants recognize and accept Litecoin as a legitimate form of payment, it boosts its utility and demand. This, in turn, can lead to positive price movements and a stronger market sentiment, making Litecoin more appealing for both investors and everyday users. The more widespread its use in everyday transactions, the more stable and prominent Litecoin’s position becomes in the crypto market.