Ever felt like traditional banking systems are too centralized and restrictive? Decentralized Finance, popularly known as DeFi, is shaking up the financial world, offering an alternative that promises more control, transparency, and efficiency. But it’s not all sunshine and rainbows; DeFi comes with its own set of legal challenges.

The rise of DeFi can be likened to the early days of the internet – a wild west scenario where pioneers are exploring unknown territories. However, as with any disruptive technology, there’s bound to be friction, especially when it rubs up against established systems.

Introduction to Decentralized Finance (DeFi)

Imagine a world where you can borrow, lend, trade, and manage your assets without going through a bank or financial institution. That’s DeFi for you. Built on blockchain technology, especially Ethereum, it enables peer-to-peer transactions, bypassing intermediaries.

The ethos of DeFi is about democratization. It aims to create a financial system where everyone has equal access, regardless of their socio-economic background or geographical location. It’s a financial revolution, and revolutions, while exhilarating, always come with challenges.

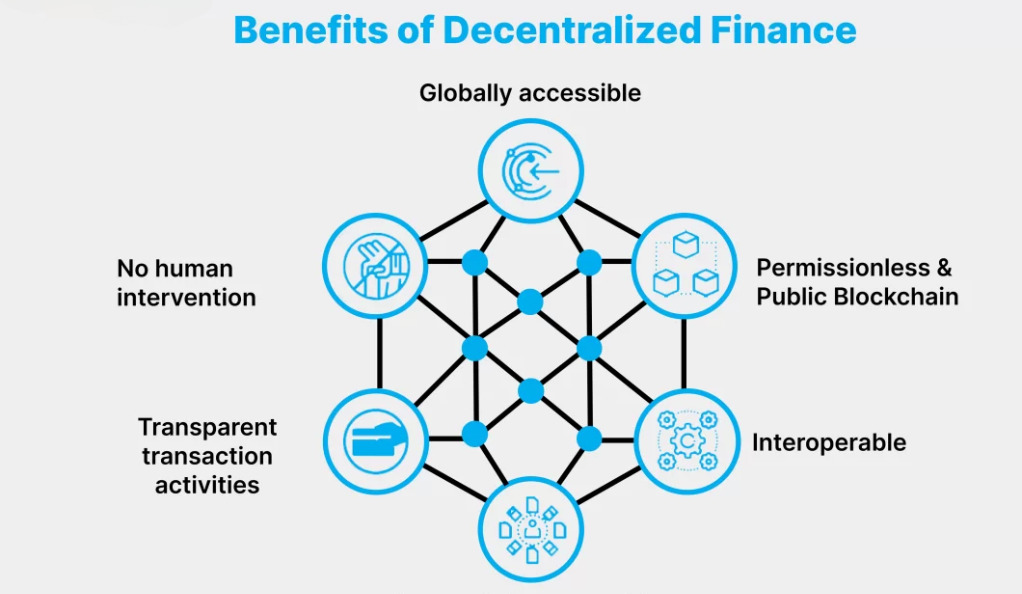

Advantages of DeFi

There’s a reason why DeFi is gaining traction. It’s breaking barriers and rewriting the financial narrative. But, what’s driving its popularity?

Financial Inclusion

Ever thought about the billions without access to traditional banking? DeFi bridges the gap, ensuring everyone, regardless of their location or financial status, can access financial services. No more being marginalized due to lack of documentation or banking facilities.

Transparency and Trustworthiness

DeFi operates on public ledgers, which means transactions are transparent. This transparency is not just about seeing your transactions, but about trust. The decentralized nature ensures no single entity has control, which is a departure from the conventional banking model.

Efficiency and Accessibility

Why wait days for a transaction when DeFi offers almost instant solutions? No holidays, no off-hours, and no bureaucracy. It’s accessible 24/7, from anywhere. The global reach and immediacy of DeFi platforms give users unparalleled financial freedom.

The Rise of DeFi and Its Legal Hurdles

With great power, comes great responsibility (and challenges). As DeFi rises, so do its legal predicaments. It’s a clash of old versus new, centralized versus decentralized.

Regulatory Uncertainty

Is DeFi a commodity, security, or something entirely different? Regulatory bodies are grappling with categorizing DeFi, leading to uncertainty. As governments try to pigeonhole DeFi into existing frameworks, the sector often finds itself in a legal limbo.

Know Your Customer (KYC) Challenges

Traditional finance rigorously checks who you are (thanks to KYC). DeFi, being decentralized, faces hurdles in ensuring users aren’t up to nefarious activities. How does a system built on anonymity ensure that it doesn’t become a hotbed for illicit activities?

Smart Contracts: A Double-Edged Sword

Automated contracts sound perfect, right? Until there’s a flaw or an unexpected event. Then comes the question: who’s to blame? In a world where codes dictate terms, the line of responsibility often gets blurred.

Key Legal Challenges in DeFi

DeFi’s decentralized nature makes it unique. But it also makes it a legal conundrum. Let’s dissect these complexities.

Lack of Central Authority

When there’s a dispute in traditional banking, there’s a clear entity to approach. In DeFi? Not so much. This decentralization is both its strength and weakness. It empowers users but also leaves them without a clear recourse in case of disputes.

Privacy Concerns and Data Security

In an era where data breaches are frequent, how can DeFi platforms guarantee the safety of users’ data? Moreover, how do they balance the demand for privacy with regulatory requirements? It’s a tightrope walk that many are still trying to master.

International Jurisdiction Issues

The borderless nature of DeFi means a transaction could involve parties from multiple countries. Whose laws apply then? As DeFi platforms operate across borders, they find themselves caught in a web of international laws and regulations.

Potential Solutions and the Future of DeFi

The road ahead for DeFi is undeniably rocky, but not insurmountable. As the saying goes, “necessity is the mother of invention.”

DeFi developers and enthusiasts are continuously working on innovative solutions to address these challenges. Collaborations between DeFi platforms and regulatory bodies can lead to a standardized framework. Moreover, enhancing security measures and educating users can make the DeFi space safer and more robust.

Conclusion

DeFi is undoubtedly revolutionary, democratizing finance. But, like all revolutions, it comes with challenges. As we stand at the crossroads, the future of DeFi depends on how it adapts and addresses these legal challenges. As the DeFi sector and regulators continue to evolve and interact, we can be hopeful for a harmonious coexistence that brings the best of both worlds.

FAQs

DeFi stands for Decentralized Finance, a system that offers traditional financial services without intermediaries using blockchain technology.

Due to its decentralized nature, it poses regulatory, security, and legal challenges, differing from traditional finance systems.

While Ethereum is the most popular, there are other blockchains like Binance Smart Chain and Polkadot that support DeFi.

Research thoroughly, use reputable wallets, and always be wary of too-good-to-be-true offers.

While it offers an alternative, it’s unlikely to completely replace traditional banking. However, it may force conventional institutions to evolve.