Cryptocurrencies, often hailed as the money of the future, have undeniably reshaped the financial landscape. Their decentralized nature and potential for high returns have attracted millions worldwide. But with such widespread adoption comes the need for order, structure, and predictability. Why regulations matter? In the vast ocean of digital assets, regulations act as the necessary buoys, providing guidance and safety. They ensure that cryptocurrency remains a tool for innovation and growth rather than misuse and deception.

Cryptocurrencies were initially introduced as an answer to the centralized financial system, offering transparency, security, and most importantly, freedom from traditional banking. However, as their popularity grew, so did the challenges and controversies surrounding them. From their role in illicit activities to potential economic disruptions, the need for a regulatory framework became evident. Regulations, thus, are not just about control but also about legitimizing and standardizing a revolutionary concept.

History of Crypto Regulations

When Bitcoin first emerged in 2009, it largely existed in the shadows. Governments and financial institutions saw it as a fleeting trend. The initial stance was predominantly of skepticism and dismissal. However, as more cryptocurrencies emerged and the market’s capitalization grew, so did concerns about potential misuse.

As cryptocurrencies began gaining traction, the shift in perspective became inevitable. Governments recognized the need to address the technological advancement not as a threat but as an opportunity. Regulations were viewed as essential to protect consumers, prevent illegal activities, and ensure financial stability. The tug of war between innovation and regulation began, and the crypto landscape started its transformative journey.

Legal Developments in Cryptocurrencies

The world is a mosaic of opinions, especially when it comes to cryptocurrencies. Some countries like Japan took progressive steps, acknowledging Bitcoin and its peers. Countries leading in crypto regulations such as Switzerland and Malta became crypto havens, crafting policies that foster innovation while ensuring user safety.

On the other hand, notable regulatory events, like China’s crackdown on crypto exchanges and ICOs or the USA’s SEC rulings on crypto as securities, showcased the diverse global approach. These events acted as defining moments, shaping the trajectory of the global crypto industry, highlighting the intricate balance between fostering innovation and ensuring security.

Tax Implications of Cryptocurrency

The realm of cryptocurrencies introduced a unique challenge for taxation. How do you tax something that isn’t recognized universally? Yet, as the saying goes, only two things are certain in life: death and taxes. Reporting gains and losses became crucial. Countries like the USA require citizens to report crypto transactions, classifying them as property for tax purposes.

The shadows of tax evasion penalties loom large. In many countries, evading taxes on crypto gains can lead to significant penalties. Ignorance is hardly ever bliss; it’s essential to understand the tax laws of one’s country concerning cryptocurrencies. After all, it’s better to part with a small portion of your gains than to face legal repercussions.

Best Practices for Compliant Investing

Cryptocurrency investing, while lucrative, is riddled with pitfalls. For novices and experts alike, understanding the landscape is essential. Due diligence for investors means researching not just the potential returns, but also the associated risks, the technology behind a coin, and its long-term viability.

The dynamic nature of the crypto industry underscores the importance of record keeping. A detailed record of transactions can be a lifesaver during tax season or if any legal discrepancies arise. Moreover, with regulations continually evolving, having a clear investment trail ensures one can adapt to any retrospective changes in the law.

Understanding Global Variances

The world, in its vastness, hosts a spectrum of views on cryptocurrencies. In some regions, regulators have crafted strict regulations to protect their economic interests and their citizens. Countries like India have swung between banning and embracing cryptocurrencies, reflecting the ongoing global debate.

On the opposite end, there are regions with tax regulations, offering more freedom but also potentially more risk. Places like Bermuda or Gibraltar have become crypto-friendly hubs, attracting businesses and investors. However, it’s vital to understand that freedom also comes with responsibility. In lax regions, the onus of due diligence falls even more on individual investors.

Challenges in Navigating Crypto Compliance

In a realm as nascent as cryptocurrency, challenges are par for the course. The primary issue many face is the ambiguity in laws. With regulations continually playing catch-up to technology, what’s permissible today might not be tomorrow.

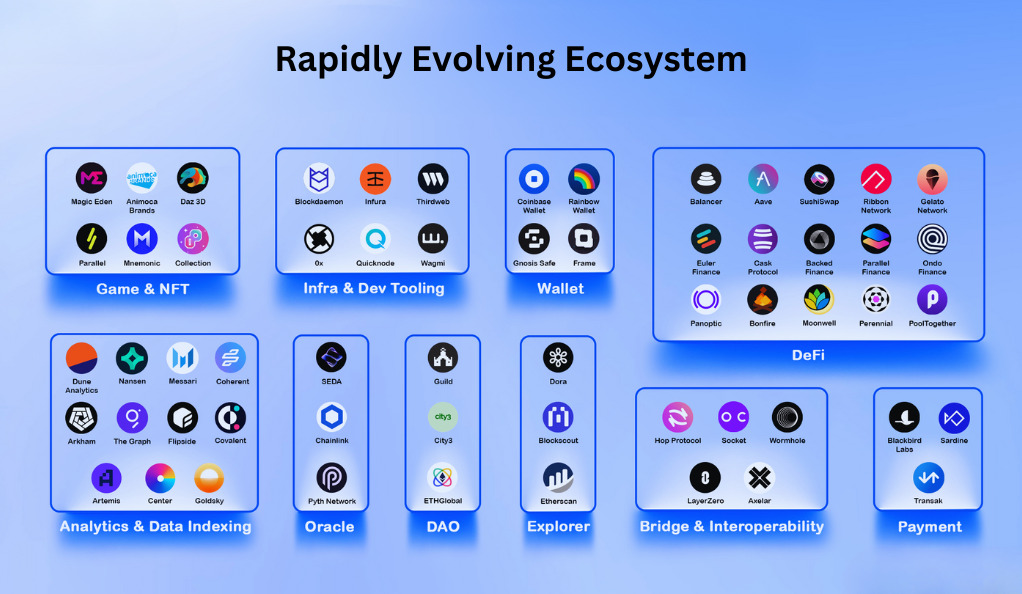

The rapidly evolving ecosystem of cryptocurrencies further complicates matters. New tokens, technologies, and use-cases emerge almost daily, often outpacing regulatory frameworks. For investors and businesses, this means remaining vigilant, adaptive, and always ready for the next curveball.

Conclusion

The intricate dance between cryptocurrencies and regulations continues. As both entities evolve, a harmonious future can be envisioned—one where innovations flourish within well-defined boundaries. The journey, while tumultuous, holds promise. By arming oneself with knowledge and staying updated, navigating the crypto-regulatory maze becomes not just feasible but also rewarding.

FAQs

They ensure transparency, legality, and reduced chances of fraud in cryptocurrency transactions.

It varies based on the region, but generally, one must report gains and losses, and there are penalties for tax evasion.

Countries like Japan and Switzerland are pioneers, while others like China have taken a stricter stance.

The primary challenges include ambiguous laws and the rapidly evolving nature of cryptocurrencies.

Absolutely. Keeping detailed records ensures you can comply with regulations and understand your investment’s trajectory.