As we stand on the brink of the digital age, the world of cryptocurrencies is rapidly evolving, offering unique investment opportunities. Litecoin, a standout in the crypto realm, presents an array of options for potential investors. This article provides a comprehensive guide into the intricate world of Litecoin investment, catering to both conservative and aggressive investors. Navigating the crypto waters can be daunting, but with the right strategies, the voyage can be rewarding.

Understanding Cryptocurrency

What is Litecoin?

Litecoin, emerging as the silver counterpart to Bitcoin’s gold, is one of the frontrunners in the cryptocurrency market. While offering faster transaction times, it uses a distinct hashing algorithm. For an investor, this distinction can provide unique opportunities. As cryptocurrencies evolve, understanding each one’s intricacies can be the cornerstone to effective investment.

Basics of Crypto Investment

Entering the crypto market is not just about seizing the moment. It’s about laying a foundation built on understanding market dynamics, recognizing trends, and aligning investment strategies with personal goals. Cryptocurrency is a universe in itself, and as with any investment, the more informed you are, the better choices you’ll make.

Conservative Investment Strategies

HODLing

In the crypto vernacular, HODLing refers to the practice of holding onto a cryptocurrency for the long haul. Think of it as sowing a seed and waiting for the tree to bear fruit. The waiting game can be challenging, especially in a volatile market, but patience often pays. For those looking for stability, HODLing can be the strategy to embrace.

Diversification

Diversifying in crypto investments is about spreading your capital across various assets. Imagine a musical ensemble; each instrument plays its part to create a harmonious melody. Similarly, diversification can help in achieving balance, reducing the impact of a poor-performing asset on the overall portfolio.

Stablecoins

Stablecoins, anchored to stable assets like the US Dollar, offer a sense of security in the chaotic crypto realm. For investors who prefer consistency, stablecoins can be the bedrock of their portfolio. They might not promise skyrocketing returns, but they offer a shield against drastic market downturns.

Aggressive Investment Strategies

Day Trading

For those who thrive on adrenaline, day trading is the crypto equivalent of riding a roller coaster. It’s about making the most of the market’s daily highs and lows. Day trading requires a keen eye, swift decisions, and an appetite for risk. But with high risk comes the potential for high reward.

Leverage & Margin Trading

Imagine being on a seesaw; that’s what leveraging in crypto feels like. It can amplify both gains and losses. By borrowing funds to trade, investors can potentially enhance their returns. However, it’s a double-edged sword and necessitates careful strategy and a solid understanding of the market.

ICOs & DeFi Investments

Jumping into ICOs (Initial Coin Offerings) and DeFi (Decentralized Finance) is like exploring uncharted waters. The allure of substantial returns is undeniable, but so are the risks. Before diving in, thorough research and understanding are imperative.

Risk Management in Crypto Investing

Understanding Risk

Risk in crypto investment is like a shadow, always present. Being cognizant of potential pitfalls helps in formulating a robust investment strategy. While one can never eliminate risks entirely, understanding them can lead to better decision-making.

Tools and Techniques

Arming oneself with the right tools and techniques is akin to having a compass in the vast ocean of crypto investments. These can range from stop-loss orders to analytical tools that monitor market trends. The crypto world is dynamic, and staying updated is the key.

Maximizing Returns

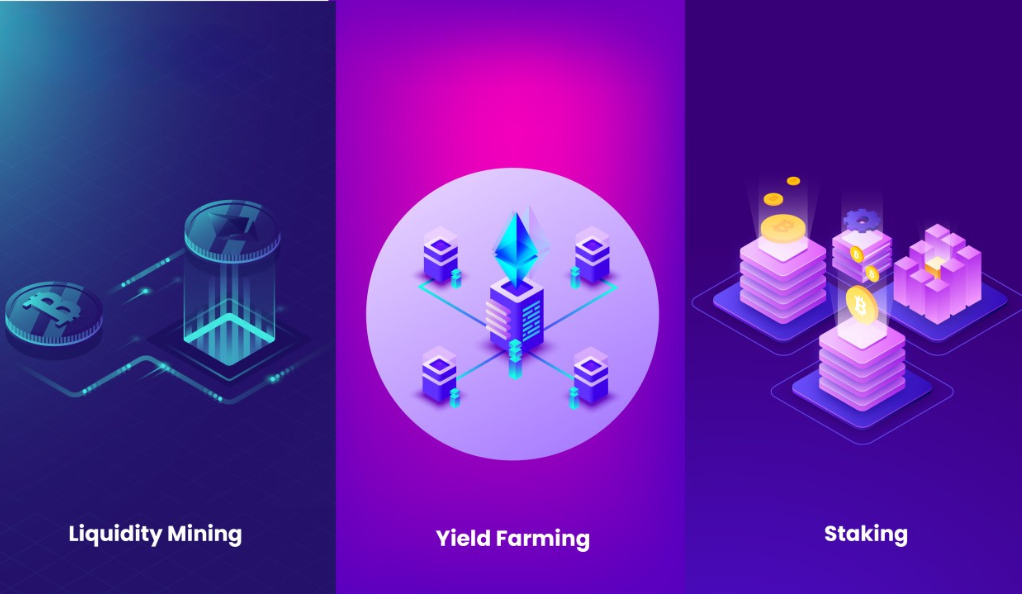

Staking

In the realm of crypto, staking can be equated to earning interest in the traditional banking system. By locking up a portion of your cryptocurrency to support operations like transaction validation, investors can earn additional rewards. It’s a passive way to grow your assets.

Yield Farming

Yield farming with Litecoin involves strategically lending or staking LTC in various platforms or protocols to earn rewards. By providing liquidity or participating in DeFi projects, users aim to earn passive income on their held Litecoin. As with all crypto investments, it’s crucial to understand the associated risks and research each platform before participating.

Liquidity Mining

Mining for liquidity is the digital version of prospecting for gold. By providing liquidity to decentralized exchanges, investors can earn rewards. However, as with any investment, it’s vital to weigh the potential rewards against the inherent risks.

Conclusion

The journey through the crypto landscape, especially with Litecoin, is filled with opportunities and challenges. By aligning your investment strategies with your risk appetite and goals, you can carve your path to success. Remember, the essence of investment lies in continuous learning, adaptation, and strategic planning.

FAQs

Polkadot enables different blockchains to communicate, ensuring a more connected and robust network.

It depends on individual risk tolerance and financial goals.

Start with long-term holding and diversification, considering stable assets.

Leverage trading can amplify both gains and losses, making it riskier.

Assessing your risk tolerance, goals, and market analysis will help you craft a personalized strategy.