Crypto investments involve the allocation of funds into digital assets, such as cryptocurrencies, tokens, and digital coins. These digital assets utilize blockchain technology to facilitate secure and decentralized transactions. As an alternative investment class, cryptocurrencies offer potential for substantial returns, driven by their volatile nature and the evolving landscape of blockchain projects. However, this volatility also brings inherent risks, necessitating a thorough understanding of the market and careful risk management. Investors interested in crypto should research different cryptocurrencies, grasp the fundamentals of blockchain technology, and consider factors like market trends, regulatory developments, and security practices before entering this dynamic and rapidly changing investment space.

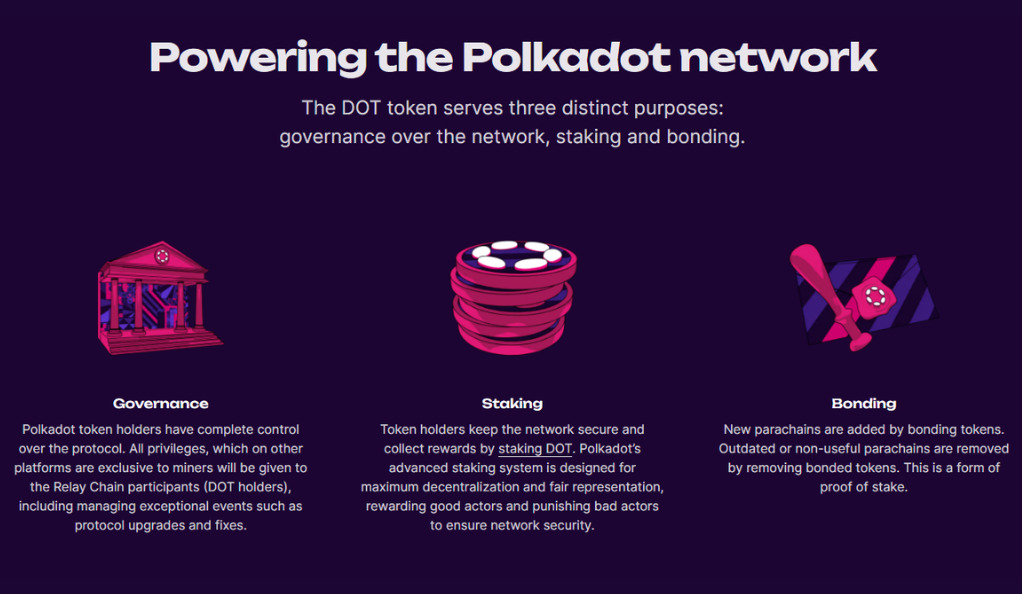

What is Polkadot?

Polkadot is a revolutionary multi-chain technology that allows different blockchains to transfer messages and value in a trust-free fashion. It’s a fascinating concept that has grabbed the attention of investors across the globe.

Conservative vs Aggressive Investing

Whether you’re a seasoned veteran or a newcomer to the crypto market, understanding your risk tolerance is essential. Are you a conservative investor looking for stability, or do you have an aggressive appetite for risk with potentially higher returns? Let’s dive in and explore both!

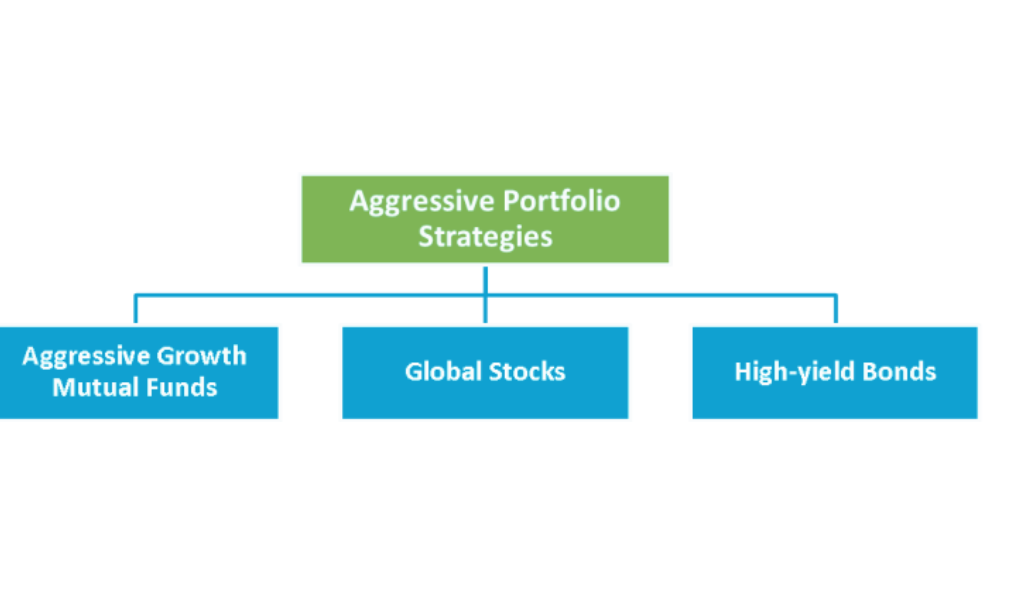

Aggressive Investment Strategies

Aggressive investment strategies involve pursuing higher returns by accepting greater levels of risk. Investors adopting aggressive approaches are willing to invest in assets with the potential for substantial gains, even if they come with increased volatility and the possibility of significant losses. These strategies often include investing in emerging markets, high-growth stocks, leveraged products, and speculative ventures. While aggressive strategies can lead to impressive profits, they demand a keen understanding of market trends, intensive research, and a high-risk tolerance. Due to the potential for substantial fluctuations in value, individuals considering aggressive investment strategies should carefully assess their financial goals, risk appetite, and ability to absorb potential losses before diving into these dynamic and unpredictable markets.

High-Risk Assets

Aggressive investment in crypto often means venturing into high-risk assets. This might include investing in newer cryptocurrencies with huge potential but also a greater chance of loss. Think of it as riding a wild roller coaster; it’s thrilling but not for the faint-hearted!

Rapid Trading

Trading frequently, sometimes multiple times a day, is another aggressive strategy. It’s like being a chef in a bustling kitchen, constantly juggling pots and pans to create a masterpiece.

Leverage and Margin Trading

These are specialized forms of trading that amplify both potential profits and losses. Imagine it as using a magnifying glass; everything becomes larger, including the risks.

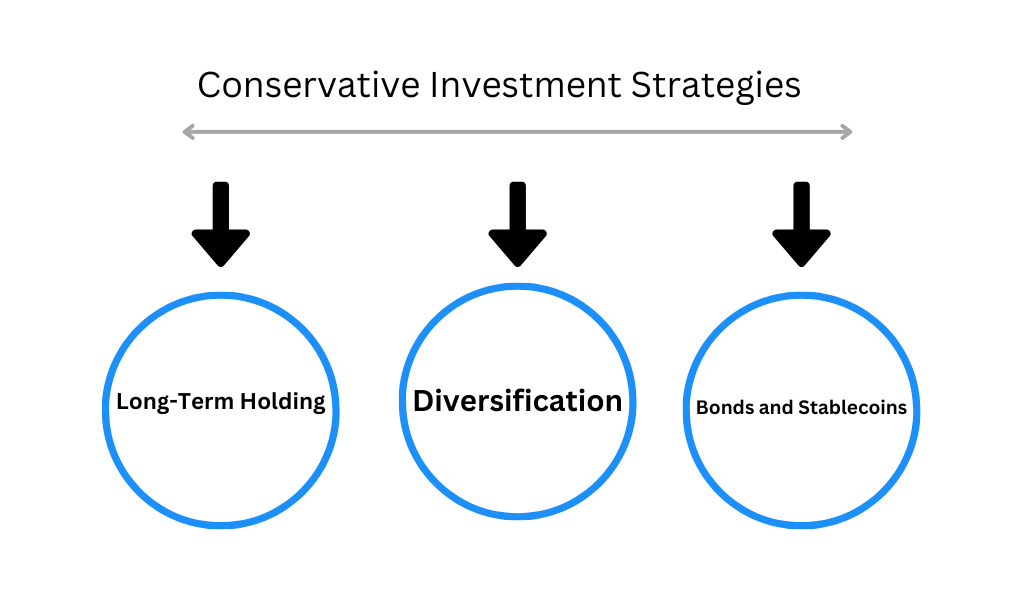

Conservative Investment Strategies

Conservative investment strategies prioritize capital preservation and stability over high returns. Investors employing these strategies typically allocate their funds to lower-risk assets, such as government bonds, blue-chip stocks, and established dividend-paying companies. The primary goal is to safeguard the initial investment and generate steady, albeit more modest, returns over time. By minimizing exposure to market volatility, conservative investors seek to maintain a balanced portfolio that can withstand economic downturns. While these strategies may yield lower profits compared to more aggressive approaches, they appeal to individuals with a lower risk tolerance, those approaching retirement, or those looking for a stable foundation within their investment portfolio.

Long-Term Holding

For those who prefer a steady journey, long-term holding is a go-to strategy. It’s akin to planting a tree and patiently waiting for it to bear fruit.

Diversification

Spreading your investment across different assets can reduce risk. Think of it as a well-balanced meal, with each element complementing the other.

Bonds and Stablecoins

Conservative investors may find bonds and stablecoins appealing, as they typically offer stability. Imagine them as the anchors of a ship, keeping it steady during storms.

Risks and Rewards

Aggressive strategies offer high rewards but come with elevated risks. Investing in volatile markets, speculative ventures, or leveraging can lead to substantial losses, especially in unpredictable events like regulatory changes.

Conservative strategies yield stable returns with reduced risk exposure. Investments in established assets provide reliable income, making them suitable for risk-averse investors and those seeking consistent growth despite lower potential profits.

Developing Your Investment Strategy

- Research and Goals: Crafting a robust investment strategy begins with thorough research and clear goals. Understand your risk tolerance, financial objectives, and time horizon. Are you aiming for short-term gains or long-term growth? Evaluate different asset classes, such as stocks, bonds, real estate, or cryptocurrencies, considering their potential returns and associated risks.

- Diversification and Monitoring: Diversifying your portfolio is key to managing risk. Allocate your funds across different assets to reduce vulnerability to market fluctuations. Regularly monitor your investments and stay informed about market trends and economic developments. Adjust your strategy as needed to align with changing goals and market conditions, ensuring that your investments remain in line with your overall financial plan.

Conclusion

Polkadot Profits offers a fascinating landscape for both aggressive and conservative investors. Like explorers on a thrilling journey, knowing your map and having the right equipment makes all the difference. Ready to embark on this exciting adventure?

FAQs

Polkadot enables different blockchains to communicate, ensuring a more connected and robust network.

It depends on individual risk tolerance and financial goals.

Start with long-term holding and diversification, considering stable assets.

Leverage trading can amplify both gains and losses, making it riskier.

Assessing your risk tolerance, goals, and market analysis will help you craft a personalized strategy.